By Bastian Stroemsheim | August 23, 2022

The IRA passed all hurdles and was signed into law by President Biden on August 16, 2022. The Act creates new investment incentives, market structures and adds more flexibility for clean energy technology developers and investors.

In this upcoming series of opinion pieces, I will distill the key changes and highlight what to expect as the market adapts to this new environment. The first step is taking a brief look at the high-level changes impacting solar, wind, battery storage, hydrogen and carbon capture.

Key takeaways

- The tax credit structure changes to incentivize fair wages, domestic manufacturing and accelerating the sustainable transition in fossil fuel-dependent communities.

- Production tax credits (PTCs) are making a comeback:

- Solar projects placed-in-service from this year can elect to use the PTC.

- A new PTC structure for hydrogen starts in 2023, while nuclear will also receive PTCs from 2024.

- Standalone battery storage (>=5 kWh) and interconnection (<= 5 MW) qualify for the investment tax credit (ITC) from 2023.

- New technology-neutral credits for PTC and ITC in 2025 with clear phaseout targets are included.

- Tax credits can be transferred from 2023 to a 3rd party in exchange for cash payment, but the depreciation benefits can’t be part of the transfer.

Understanding the new tax credit structure

The new structure is designed as a two-tiered system where bonuses can be added on top of the full rate if certain conditions are met. For each technology, there is a defined base rate which receives a 5x multiplier if the project meets the prevailing wage and apprenticeship requirements.

Satisfying the following requirements allows for bonuses to be stacked on top of the full rate credit.

- Domestic content: Additional maximum 10% PTC or 10% points ITC if certain project materials are produced or manufactured in the US.

- Energy community: Additional maximum 10% PTC or 10% points ITC if the project is located in a defined ‘energy community’, which covers areas with a current or former tie to fossil fuels production.

- Environmental justice solar and wind capacity (ITC only, <=5MW):

- Additional 10% points if located in low-income community or Native American land.

- Additional 20% points if part of qualified low-income residential building or low-income economic benefit project.

If the prevailing wage and apprenticeship requirements aren’t met, the domestic content and energy community bonuses are reduced from 10% points to 2% points for the ITC only, meaning the 5x multiplier applies to the ITC domestic content and energy community bonuses as well.

Tax credits and availability by technology

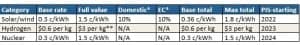

PTC

The previous PTC rate was set to 1.5 c/kWh in 1992, and in the case of wind, the inflation-adjusted rate was 2.6 c/kWh in 2022. The solar PTC expired in 2006. A selection of new PTC rates are listed below, and these will continue to be adjusted for inflation during the 10-year credit period.

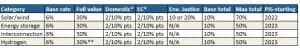

ITC

Before the law passed, the ITC rate for start of construction in 2022 was 26% and set to step down to 22% in 2023. The list below compiles key technologies qualifying for ITC and the maximum rate they could receive.

Notes

Thresholds: Facilities <1MW receive full rate automatically. Energy storage (>=5 kWh), interconnection (<=5 MW), env. justice (<= 5 MW).

Base total refers to projects unable to meet prevailing wage and apprenticeship requirements while receiving domestic content and energy community bonuses. Under this scenario, the bonuses will be 2% points each instead of the full 10% points. No environmental justice bonus added.

PIS-starting – refers to the placed-in-service date of the project. PIS-starting in 2022 means the project must be placed-in-service after 12/31/21 to qualify.

*Domestic content & Energy community (EC) bonuses available for projects PIS after 12/31/22. Env. justice available for calendar years 2023 & 2024 with a max allocation of 1.8 GW p.a.

**Different full rate outcomes depending on lifecycle emissions rate. The $3 per kg PTC and 30% ITC assume the project qualifies for the highest rate. In our upcoming hydrogen post, we will dive further into the different rates.

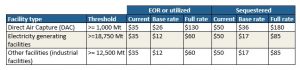

Carbon capture (45Q)

The carbon sequestration rates ($ per metric ton) are set by the facility type and capture method. It distinguishes between carbon utilized and carbon sequestered, meaning if the carbon is reused in the production process or captured for the purpose of long-term storage. The credit period is set to 12 years and applies to projects placed-in-service starting in 2023. Similar to the PTCs, these credits are also subject to inflation adjustments.

Future PTC & ITC

In 2025, the current PTC and ITC structure will change slightly. Tax credits transition to a technology-neutral system, meaning any facility with greenhouse gas emissions at or below zero can decide between the PTC and ITC. The new PTC and ITC will have a similar two-tiered system with bonuses, with rules regarding when the gradual phaseout starts. The earliest start for the phaseout is 2032, and it could also be extended if power sector emissions have not fallen by 75% or more compared to the 2022 baseline emissions.

Credit monetization

Beyond the traditional tax equity structure, the new legislation allows for direct pay and transferring credits under certain circumstances. Direct pay acts as an overpayment of taxes, and the cash payment is received as a refund from the IRS. The option of direct pay is limited to a list of tax-exempt entities, unless the partnership involves clean hydrogen PTCs (45V), carbon capture (48Q) or advanced manufacturing. Under these circumstances, the taxpayer can opt for direct pay during the first 5 years after the placed-in-service date and still receive tax credits for the remaining years of the credit period.

Another option is to transfer the credits to a 3rd party for a cash payment. The IRS will impose a 20% penalty if the credit amount is overstated, and it is not possible to monetize the depreciation benefits as part of the transfer. Credits obtained by applying carrybacks and carryforwards can’t be transferred either.

Credit flexibility

Starting in 2023, the carryback period increases from 1 to 3 years, and the carryforward period increases from 20 to 22 years. Tax credits may, in some cases, not fully offset corporate taxes due to a new 15% corporate alternative minimum tax. The tax applies to U.S. corporations with at least $1 billion in average annual earnings in the past 3 years. Additionally, subsidiaries with foreign parents are liable if average annual earnings are higher than $100 million over the past 3 years. Tax credits can offset up to 75% of the combined regular and minimum tax above $25,000.

Stay up to date about Pivotal180 and the Inflation Reduction Act.by signing up to our newsletter, see form on this page. In the coming weeks, we will be publishing further analysis about market expectations and tradeoffs between the different tax credit structures.

Please use links below to find out about Pivotal180 and our financial modeling courses and experience the Pivotal180 difference.

- Project finance and infrastructure financial modeling

- Renewable energy project finance modeling

- Tax equity modeling

- Introduction to Battery Storage

Share This Resource