By Alison Leckie | April 23, 2021

In all Pivotal180 financial modeling courses, when we build the model, we build in forecasts for the three key financial statements. The three financial statements help to understand the business activities and financial performance of a business. By forecasting these statements, we can analyze how the project or business will perform under a variety of different sensitivities and scenarios.

You probably already knew about the importance of these financial statements for your model, but what are they exactly? How are they linked? And is any one more important than the other?

Before I launch into the world of financial statements let me tell you a little about me. I am one of the founders of Pivotal180 together with Haydn and Dan. My background is very different as I am not a modeler and have not been involved in actual project finance deals. My expertise is in finance with over 30 years’ experience as a CFO for companies including SAP, Giorgio Armani and Corality. I have therefore been using these financial statements for a long time that I had forgotten that they are a learned skill and not part of my DNA.

We use these statements in our financial modeling so it is important we introduce them to you properly.

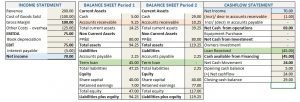

The three key financial statements are:

- Balance Sheet

- Income Statement (Profit and Loss Statement or P&L)

- Cashflow Statement (Cash waterfall)

All three of these statements connect with each other, and one should never develop a forward-looking model for any business without them. These are used by investors, analysts, and creditors to evaluate the health and earning potential of a business.

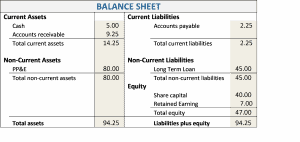

BALANCE SHEET

The balance sheet tells you about the health and net worth of a business. It is a snapshot of a business’ performance at a single point in time

It comprises of

- Assets – these are what the business owns or is owed

- Liabilities – what the business owes to others

- Equity the owners’ investment and the retained earnings

The fundamental rule of accounting is

ASSETS = LIABILITIES PLUS EQUITY (or if you are an Australian, Assets – Liabilities = Equity, but that is another story)

A balance sheet is further categorized as follows

Current Assets can be used in less than 12 months

- Accounts receivable – amounts owed by clients

- Cash and cash equivalents

Non-Current Assets lasts more than 12 months

- Capital items such as plant and equipment

Current Liabilities due in less than 12 months

- Accounts payable – amounts owed to suppliers of services

Noncurrent Liabilities due in more than 12 months

- Debt provided to the business

Equity paid up capital and retained earnings

- Opening retained earnings + Net Income – Distributions = Ending retained earnings

- Equity represents the amount of money that would be returned to shareholders if all the assets were liquidated and all the company’s debt was paid off.

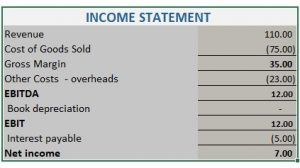

INCOME STATEMENT

The Income Statement records how much a business has earned and spent over a period of time, reflecting the profitability of a business

It tells you the financial strength of the business. It includes all the sources of income and costs – including items that are not cash related. The income statement calculates the profit of the business called net Income

It is often considered the most important financial statement from an accounting perspective and is usually the first place an investor will look

An income statement does not match the cash flow statement. Accounting principles such as accruals, prepayments are used to determine net income. Accrual accounting calculates the receipts instead of the actual cash.

Revenue is recorded at the time of the sale, even if the customer has not paid. It therefore is revenue but no cash has been received so it does not appear in the cash flow statement. The other side of the entry is accounts receivable being the amount owed by a customer for a service performed but not paid. As it is money owed to the company it is reflected as an asset on the balance sheet. When the cash is received, we reduce the accounts receivable balance and increase cash.

Other non-cash items such as depreciation appear in the income statement but not the cashflow statement

Some terms you may not be familiar with our income statement below are

- Cost of Goods Sold (COGS) also referred to as the cost of sales or cost of services, is how much it costs to produce your products or services.

- EBITDA Earnings before interest, tax, depreciation, and amortization.

- EBIT Earnings before interest tax.

I have ignored tax to keep things simple in line with our financial modeling courses.

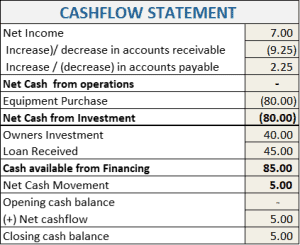

CASHFLOW STATEMENT

A cashflow statement tracks all the cash inflows and outflows in a business over a period of time

The cash flow statement measures how well a company generates cash to fund the operating activities, pay its debt and fund investments.

Reflects only the cash movements and tells us how much cash the business generates.

The cash flow statement takes net income and adjusts it for any non-cash expenses.

How are the three statements linked?

Accountant commonly calculate the cash flow by starting with the income statement and movements between the two balance sheets within the period to calculate the cash flow. For example, if the long term of 45K is repaid the liability in the balance will reduce by 45K. Cashflow will reflect this by taking the delta of the balance sheet at the end of each period. (0-45k). The cashflow will show -45K as loan has been repaid and will show as a reduction in cash available from funding.

(In fact, a cash flow can be totally derived from the balance sheet and income statements but that is another blog)

In our financial modelling courses, we start with the cashflow and then create the income statement and balance sheet from the cashflow This is known as the direct method. We find that analysts tend to create more straight forward forecasts by using this method

The cashflow links to both the income statement and balance sheet

The net Income from income statement is the first line of the cash flow statement the net income from the profit and loss also becomes part of the retained earnings in the balance sheet

The closing cash balance equals to the cash in the balance sheet A cashflow statement is in effect a reconciliation of the changes in the prior period over current period balance sheet

This will all become much clearer once you work through building a three-way statement in our financial modeling courses.

Which Financial Statement is the most important?

From an accounting perspective there is no consensus, I think it is the balance sheet where others would argue it is the income statement BUT in project finance the cashflow waterfall is the most important financial statement.

This is referred to the cash flow waterfall or cash cascade in the context of project finance This is similar to the cashflow statement, but the cashflow waterfall shows the priority of each cash inflow and outflow from the project. And this is an important distinction!

As cash is so important in project finance, the financial statement of most interest to the lenders and investors is the cashflow waterfall

This is just an introduction financial statements and they do become harder and more complicated. If you are interested in learning more about financial modeling for business planning please Speak to us about our tailored courses

Learn more about the cash waterfalls in Haydn’s blog

The cashflow waterfall is a must-know for all project finance participants. Our courses go into further detail than what we cover here. Our financial modeling courses that teach this in more detail are:

Share This Resource