By Diego Castrillon | August 26, 2022

If you follow the energy world as we do, you are aware of the massive impact of the Inflation Reduction Act (IRA) on our economy and our sustainability as a society. We are talking about USD 369 billion in energy security and climate change provisions. It covers a massive array of technologies and credits, but here at Pivotal180, we have summarized the main implications in our article Navigating the Inflation Reduction Act , so you do not have to do it yourself. Since we like discussing clean hydrogen in our recent blog series. Hydrogen: a key player in the net–zero race and Hydrogenating Storage

Let’s now continue the series discussing Hydrogen in the context of the IRA.

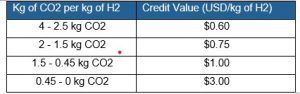

What is considered as “clean hydrogen” in the IRA? Of course, the ideal scenario is to have an economy based on pure, clean, zero-carbon hydrogen (0 kg of CO2/kg of H2). To tolerate certain flexibility, the IRA term, this Act provides credits for low-carbon production. To begin, the IRA provides a production tax credit (PTC) for ten years depending on the carbon intensity from the lifecycle emissions (kg of CO2/kg of H2) on each facility that is “placed in service” after December 31st, 2022. The allowed range to access the credit spans 0-4 kg CO2 per kg of H2. These emissions are based on the GREET (Greenhouse gases, Regulated Emissions, and Energy use in Transportation) model, which considers emissions up to the production point. More specifically:

To access the full multiplier (or, in other words, to access the $3.00 USD/kg of H2), wage and apprenticeship requirements must be met, which are determined by the different government agencies.

In other words, this tax credit is “source agnostic”: it is neutral on the process by which the hydrogen is derived. The tax credit can apply to projects that generate green hydrogen from zero-carbon electricity through an electrolyzer or to projects that create blue hydrogen from steam methane reforming and use carbon capture and storage technologies. The Act has structured the tax credits based on emissions rather than conventional/non-conventional sources.

Importantly, hydrogen with lifecycle carbon higher than 4 kg of CO2/kg of H2 is not eligible for credits, reinforcing the priority of opting for cleaner energy sources and outputs (throughout their lifecycle). Finally, to obtain these credits, it is implicit that companies will have to properly measure their different emissions, generating transparency in the system and information spillovers across sectors.

And yes, there are other alternatives to choose from. Taxpayers may elect to use the Investment Tax Credit (ITC) up to 30% depending on the carbon intensity of the production process and if, as in the PTC, wage and apprenticeship requirements are met. The new ITC extends through 2024 before transitioning to a technology-neutral ITC in 2025. Moreover, the IRA also includes incentives to facilitate the use (not only production) of hydrogen, with an increase to the 30% credit cap for the Alternative Fuel Refueling Property Credit from USD 30,000 to USD 100,000 credits for fuel cell vehicles to be applied to any single refueling property. Finally, the Act creates a new Clean Vehicle Credit, which includes USD 7,500 in credits for new purchases and up to USD 4,000 for used fuel cell electric vehicles. I wonder what will the priority be between fuel cells and electric vehicles (or who knows, maybe both can be developed parallelly).

Lastly, in addition to tax credits, the proposal offers grants and funding opportunities for deploying hydrogen and fuel cell technologies, such as manufacturer loans for advanced technology vehicles, grants for domestic production of electric cars, and other funds to deploy heavy-duty zero-emission vehicles, decarbonize ports, and develop advanced industrial facilities.

What does this mean for the U.S.? These incentives will likely make the U.S. one of the cheapest regions in the world for clean hydrogen production, increasing the region’s competitiveness and ensuring a hydrogen economy for the clean energy transition. This IRA provides incentives for clean production and clean use. A USD 3 credit by the U.S. government will reduce the cost of green hydrogen reduction, which follows the United States’ “Hydrogen Shot” initiative launched in 2021, with the goal of reducing the cost of clean hydrogen by 80% to USD 1 per 1 kilogram in 1 decade (“1 1 1”).

Please use links below to find out about Pivotal180 and our financial modeling courses and experience the Pivotal180 difference.

Share This Resource