By Bastian Stroemsheim | July 12, 2023

The Inflation Reduction Act (IRA) was signed into law by President Biden on August 16, 2022. The Act creates new investment incentives, market structures and adds more flexibility for clean energy technology developers and investors.

The new tax credit structure of the IRA has led to a quest for clarification. Over a series of opinion pieces, I aim to distill the key changes and highlight what to expect as the market adapts to this new environment.

Previous pieces in this series includes:

- Navigating the Inflation Reduction Act

- Prevailing wage and apprenticeship requirements

- Credits for environmental justice and advanced energy projects

- Taking steps to define a US energy community

The IRS published guidance on direct pay and transferability on June 14, 2023. Although the guidance is awaiting stakeholder feedback and a potential public hearing, the current documents offer valuable insights for how credits will likely be monetized under these new structures.

Direct Pay

The guidance for direct pay expanded on which entities can opt for direct pay. Past information outlined tax-exempt organizations, State and local governments, Indian tribal governments, Alaska Native Corporations, the Tennessee Valley Authority, and rural electric cooperatives would be eligible. Part of the guidance clarifies the exact definition of these entities. For example, the District of Columbia and U.S. territories are also considered eligible. With U.S. territories, a special rule applies where facilities owned by the territory government can only qualify for PTC and not investment-based credits.

In cases where multiple applicable entities form a partnership or are organized as an “S corporation”, direct pay is only available under 45Q, 45V and 45X.

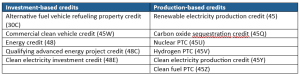

The following list provides a breakdown of the investment-based and production-based credits.

As a first step to claim direct pay, an initial registration process is required. The actual election is made when the tax returns are filed, which could take into account filing extensions. In certain cases, tax-exempt financing from grants and forgivable loans can reduce the overall credit received.

Lastly, the direct pay election can be revoked by a taxpayer claiming 45Q, 45V and 45X credits. This would count for the current taxable year and all the remaining years, meaning it is not possible to reinstate direct pay after actively revoking the option.

Transferability

With a transfer of credits, the guidance confirmed it is not a binary choice – also a portion of the tax credit can be transferred while another portion is retained in the partnership. Although the transfer might be structured for multiple years, the transfer election must be made for each year tax credits are claimed.

There are limitations for how to split the tax credits in order to avoid a transfer of the ‘riskier’ bonus credits. Therefore, a proportionate amount of the base credit must be paired with the bonus credit for any credit transfer.

The credit transfer can only be paid in cash, and is treated as tax-exempt income. Restrictions are in place to avoid a second transfer of the credits, but in cases where brokers are used to sell credits, this process does not violate the “no second transfer” rule.

In the event of a recapture, the buyer of the tax credits will often be liable to the IRS as the taxpayer. When excessive credit amounts are transferred, the buyer of the credits is liable to repay the excessive credit transfer with a 20% penalty.

The guidance also touches upon the impact of nonrecourse financing and the potential for reducing the credits available to transfer. When the partnership is using nonrecourse financing, the at-risk limitations imposed by the IRS can restrict the amount of tax credits. This will also impact the partnership’s ability to transfer credits.

Pivotal180

Stay up to date about Pivotal180 and the Inflation Reduction Act.by signing up to our newsletter, see form on this page. In the coming weeks, we will be publishing further analysis about market expectations and tradeoffs between the different tax credit structures.

Please use the links below to find out about Pivotal180 and our financial modelling courses and experience the Pivotal180 difference.

Share This Resource