By Bastian Stroemsheim | April 11, 2023

The Inflation Reduction Act (IRA) was signed into law by President Biden on August 16, 2022. The Act creates new investment incentives, market structures and adds more flexibility for clean energy technology developers and investors.

The new tax credit structure of the IRA has led to a quest for clarification. Over a series of opinion pieces, I aim to distill the key changes and highlight what to expect as the market adapts to this new environment.

Previous pieces in this series include:

Navigating the Inflation Reduction Act

Prevailing wage and apprenticeship requirements

Credits for environmental justice and advanced energy projects

Last week, the US Treasury released guidance for the energy community bonus. It confirmed aspects already expected of the credit, while introducing a couple of new elements to consider.

At a high-level, here’s what to focus on:

- Availability

- The bonus is only available for PTC (45) and ITC (48), and the extension of these credits through the technology-neutral 45Y and 48E credits. This means this bonus is not applicable for 45Q and 45V credits.

- Bonus amount

- The credit equals 10% of either the base credit or full rate for PTC, depending on complying with the prevailing wage and apprenticeship requirements. At a full rate, the 10% addition equals $2.75 per MWh. For ITC, the credit is increased by either 2 percentage points or 10 percentage points, and this is also contingent on the prevailing wage and apprenticeship requirements.

- Location matters

- Verifying if a project is within an energy community will depend on where the nameplate capacity is located. If nameplate capacity is not available, a footprint test will be applied.

- Nameplate capacity: If 50% or more of the nameplate capacity is located in the energy community, it qualifies. In cases where the nameplate capacity is situated offshore, the location of the substation will be the determining factor.

- Footprint: If the project has no nameplate capacity, the qualifying measure will be 50% or more of the project square footage.

- Verifying if a project is within an energy community will depend on where the nameplate capacity is located. If nameplate capacity is not available, a footprint test will be applied.

- A future need for ‘safe harbor

- Testing whether a project is located in an energy community will happen each taxable year if claiming the PTC. However, if the project begins construction according to the safe harbor rules, the classification will last the entire credit period.

Defining the areas

There are 3 categories to determine if an area is considered an “energy community”. The notice divides areas into MSAs and Non-MSAs (metropolitan statistical areas). MSAs are defined areas by the Office of Management and Budget (OMB), while Non-MSAs are grouped up counties according to the US Bureau of Labor Statistics (BLS).

- Brownfield site

- Land with the presence or potential presence of hazardous substances, pollutants, or contaminated and mine-scarred land. The notice lists exact requirements that would ‘safe harbor’ a brownfield site.

- Statistical area

- Areas need to satisfy both requirements for reliance on fossil fuel industry and unemployment rates.

- The presence of fossil fuel industry can be satisfied through employment or tax revenue. The fossil fuel employment relies on NAICS codes to determine qualifying jobs, and the threshold is 0.17 percent or greater directly employed. For tax revenue, it’s 25% or greater local tax revenues from extraction, processing, transportation or storage of coal, oil or natural gas.

- The unemployment rate must be at or above the national average for the previous year. The IRS and Treasury will publish lists annually in May of qualifying areas. In other words, the May 2023 list will remain in effect until May 2024, and rely on 2022 employment data.

- Areas need to satisfy both requirements for reliance on fossil fuel industry and unemployment rates.

- Coal closure

- A census tract, or a tract directly connected to it, with a recent closure of a coal mine or retirement of a coal-fired electric generating unit.

- For coal mines, recent is defined as after December 31, 1999. For coal-fired electric generating units, the cut-off date is December 31, 2009.

- A census tract, or a tract directly connected to it, with a recent closure of a coal mine or retirement of a coal-fired electric generating unit.

Digesting the information

The guidance was published with appendices detailing the qualified areas, as well as a mapping tool for visualization. Another useful tool is the “Coal Power Plant Redevelopment Visualization Tool”. This highlights currently retired and planned retirements of coal power plants, and lists valuable information such as distance to substation, ports, power plants and rail roads.

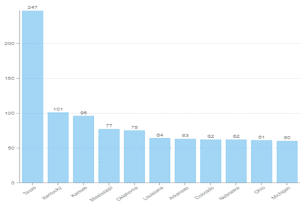

Below is a chart of the qualifying areas meeting the 0.17% or greater employment requirement for the fossil fuel industry. It’s important to note that this is not a final list, since it will also depend on the unemployment rates to be published in May 2023. Not surprisingly, Texas is by far the state with most qualifying areas, with Kentucky and Kansas taking the next spots.

Stay up to date about Pivotal180 and the Inflation Reduction Act.by signing up to our newsletter, see form on this page. In the coming weeks, we will be publishing further analysis about market expectations and tradeoffs between the different tax credit structures.

Please use the links below to find out about Pivotal180 and our financial modelling courses and experience the Pivotal180 difference.

Share This Resource