By Bastian Stroemsheim | December 3, 2024

Understanding the US energy storage boom

U.S. battery storage investments and capacity additions to the grid have picked up pace in the past years. Since 2023, ~15 GW of batteries have been added, the equivalent of roughly 15 nuclear power plants. The advancement is partially explained by banks becoming more comfortable with PF-debt for these projects and favorable regulations pushed at the federal level, but these factors fail to tell the full story. Behind the numbers, it is clear California and Texas are leaders in deploying energy storage assets.

Current capacity concentration

Overall, battery energy storage systems provide a nameplate capacity of close to 25 GW to the US electricity grid. Most of the capacity is located in California (11 GW) and Texas (6 GW). Assessing the EIA’s planned capacity additions in the coming years, the growth is expected to remain concentrated in these areas:

- Texas will have another 3.4 GW added in November and December of 2024, and 5.2 GW in 2025.

- California will have another 1.7 GW come online by 2024, and 3.4 GW in 2025.

There are five large new battery storage projects scheduled to be deployed in California and Texas in 2024-2026:

- Lunis Creek BESS SLF (Texas, 621 MW)

- Clear Fork Creek BESS SLF (Texas, 600 MW)

- Hecate Energy Ramsey Storage (Texas, 500 MW)

- Bellefield Solar and Energy Storage Farm (California, 500 MW)

- Dogwood Creek Solar and BESS (Texas, 443 MW)

Conditions supporting the storage expansion in CAISO, WECC & ERCOT

- Region-specific demand, as for example data centers in ERCOT that require firm capacity

- Fast permitting process in ERCOT

- Favorable market conditions for batteries with high renewable generation share (high spread between charging and discharging prices)

- A falling cost curve as deployment has increased

Use cases & revenue breakdown

Batteries can operate under different use cases, such as:

- Tolling agreement

- Energy arbitrage

- Ancillary services (frequency regulation and spinning reserves for example)

According to EIA data, utilities list arbitrage as the top primary use case for batteries, with frequency regulation, excess wind and solar generation and system peak shaving also mentioned.

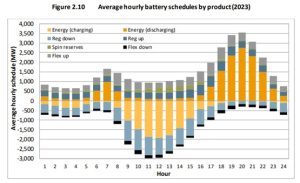

In addition, the storage system can be co-located with a generation system (majority solar). This is increasingly the case in CAISO, where half of planned capacity additions are co-located projects. These projects can also take on a contracted structure with a PPA. CAISO’s battery storage report provides a breakdown of the battery use case by hour. Energy charging and discharging (arbitrage) is reserved for the mid-day hours when the cost of charging is relatively cheaper due to solar production, while the discharge of stored electricity happens either in the 6-8am morning window or 6-11pm window in the evening.

Addressing the revenue volatility

- Volatile prices can be significant drivers of battery revenues. In ERCOT, 51% of battery storage revenue from January-August 2023 was generated during a 10-day window with high demand.

- Coupled with questions around augmentation costs and the fact that back in 2021, only 14 utility-scale batteries globally had been operating for more than 10 years, and it’s clear lenders can be uncomfortable with these project types.

- To make projects more financeable, a number of options exist:

- Contracted offtake structures, capacity payments and hedges to secure more reliable cashflows

- Flexible debt products with cash sweeps to mitigate distribution lock-ups and defaults

- Seasonality / debt service reserve accounts

Check out the links below to learn more about Pivotal180 and our financial modeling courses and services. Experience the Pivotal180 difference.

Share This Resource