By Bastian Stroemsheim | March 22, 2024

On March 5, the IRS published the final regulations for direct/elective pay. This solidifies which entities and tax credits are applicable, and when the payments are received. Still, some questions around “chaining” and partnership treatment remain open.

See this link for the original document.

Summary of temporary rules

Last year, the IRS published the initial guidance for direct pay. These were temporary in nature, allowing for a 60-day public comment period before issuing final rules. At a high-level, the following rules were introduced:

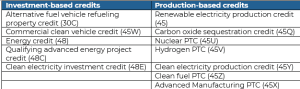

“Applicable entities” can elect direct pay for the following 12 tax credits:

Applicable entities are defined as:

- Tax-exempt organizations

- State, local and Indian tribal governments (including US territories)

- Alaska Native Corporations

- Tennessee Valley Authority

- Rural electric cooperatives

For partnerships, direct pay only applies to the following 3 credits (during the first 5 taxable years):

- Hydrogen PTC (45V)

- Carbon oxide sequestration credit (45Q)

- Advanced manufacturing PTC (45X)

The repayment structure

A selection of the 151 written comments made their way into the final ruling, giving a glimpse into some of the key points stakeholders wanted the IRS/Treasury department to address.

A number of comments asked for clarity and greater flexibility between making the direct pay election and receiving the payment from the government. Under the current rules, there are no restrictions on payments received and they could be applied to repaying loans. This could create a timing mismatch, impacting the ability to repay debt. Solutions such as requiring the IRS to issue the refund within 45 days of filing, a pre-payment mechanism and using the payment against quarterly estimated taxes were submitted, but in the end direct pay remains an annual payment received whenever the IRS has processed the filing.

Missing pieces – “chaining” and partnership treatment

“Chaining” refers to the option to purchase a credit through transferability and elect direct pay for the transferred credit. In the final rulings, the IRS/Treasury department underlined their view on direct pay and tax credit transfers as mutually exclusive regimes, mainly to maintain a clean division between the programs to avoid potential fraud. However, a notice was released asking for comments on “chaining” to inform future rulemaking, meaning some forms of “chaining” could be permissible in the future.

Lastly, guidance was released expanding an option for joint ownership arrangements to opt for direct pay. By fulfilling a set of four requirements related to the ownership and operating agreements, a path is available for certain partnerships to elect out of partnership treatment under subchapter

Please use the links below to find out about Pivotal180 and our financial modelling courses and services. Experience the Pivotal180 difference.

Share This Resource