By Alison Leckie | May 18, 2021

In my last blog I introduced you to the three key financial statements that we build into all Pivotal180 financial modeling courses, as one should never develop a forward-looking model for any business without these three financial statements.

There is however a fourth financial statement which is equally important to understand when building financial models.

Welcome to the

Statement of Retained Earnings or Statement of Shareholders Equity (Owners)

The statement of retained earnings provides a concise reporting of the changes in retained earnings from one period to the next.

The statement of shareholders’ equity can be used in lieu of the statement of retained earnings. The statement of shareholders’ equity shows not only the changes in retained earnings, but also changes in other equity accounts in the balance sheet.

Please note equity represents the amount of money that would be returned to shareholders if all the assets were liquidated and all the company’s debt was paid off. It is the total of retained earnings and owners’ equity.

Purpose of the Statement of Retained Earnings

Retained earnings is used to show investors and the market how the business is doing and how much can be reinvested back into its operations or distributed to shareholders.

The statement of retained earnings is used whenever a business is fundraising, as Investors need to know what a business or project is doing with the profits being generated and what activities they have in place to ensure high returns to shareholders

Retained earnings are shown is the balance sheet within equity and are equal to the amount of net income left over once you have paid out dividends (distributions) to shareholders. The statement of retained earnings therefore tells you whether your business has made a profit or loss over the period.

Retained earnings is equal to:

Opening retained earnings + Net Income – Dividends Paid = Ending retained earnings

- Opening retained earnings are the funds you carry over from your previous accounting period.

- Net income (or loss) is your business’s revenue minus expenses

- Dividends paid is the amount you distribute to your Statement of Changes in Equity

Retained earnings, represent the net income, which has not yet been distributed among the participants/shareholders of the company.

So a higher retained earnings can mean higher profits or smaller distributions. Retained earnings are usually higher in starts ups when any profits are being retained in the business to reinvest rather than being distributed to the shareholders.

The decision to retain the earnings or to distribute it among the shareholders is usually left to the company management.

Over the life of a project finance project

The sum of Net Income must be equal to the sum of Net Cash Flow distributed to investors minus the equity investment made by the investor. At the end of any project finance project the Equity will be Zero, that is the Retained earnings will be fully distributed

Note that in a project finance financial model retained earnings goes negative over the life of the project, but that’s okay It is quite standard. All it is saying is that the project’s paid out more in distributions than it has earned. It has paid out more in distributions to exactly the same amount as the Owners’ Equity. This is because the equity holder needs to receive his or her money back for this to be a worthwhile investment, that’s all.

Linking of the four financial statements

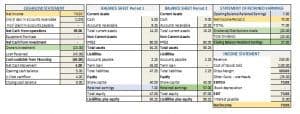

In the above financial statements we can see the link between various statements

The movements in the statement of retained earnings are linked to the other financial statements as follows

Beginning and closing retained earnings are the same as the amount of retained earnings in the period 1 and period 2 of the balance sheet.

Net income in the statement of retained earnings matches the net income in the income Statements

Finally the distributions match the owners investment in the cashflow. This reduction in cashflow statement is also reflected in the cash in the balance sheet.

This is just an introduction to retained earnings. Our courses go into further detail than what we cover here, but hopefully this blog will help you when modeling retained earnings in your financial models.

Our financial modeling courses that teach this in more detail are:

Share This Resource