By Bastian Stroemsheim | February 16, 2023

The Inflation Reduction Act (IRA) was signed into law by President Biden on August 16, 2022. The Act creates new investment incentives, market structures and adds more flexibility for clean energy technology developers and investors.

The new tax credit structure of the IRA has led to a quest for clarification. and over a series of opinion pieces I aim to distill the key changes and highlight what to expect as the market adapts to this new environment.

In my first piece, Navigating the Inflation Reduction Act I took a brief look at the high-level changes impacting solar, wind, battery storage, hydrogen and carbon capture.

In my second pieces Guidance on Prevailing Wage and Apprenticeship Requirements I reviewed the key takeaway of these requirements which are the key drivers of the final credit value.

Just in time for Valentine’s Day, the IRS issued guidance for two credits impacted by the Inflation Reduction Act (IRA) on February 13. The guidance was anticipated, since the IRA set a deadline of 180 days to issue guidance on both low income environmental justice and advanced energy projects.

Please see the links here for the notice for environmental justice allocation and the notice for advanced energy projects.

Key takeaways

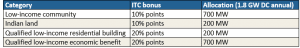

Low-income environmental justice credits

- The notice provides more clarity on how each category is defined, and the allocation of the bonus credits. As a reminder, a project can only qualify for either the 10% or 20% points ITC bonus – it is not possible to receive both.

- If a category is not able to distribute its quota, the remaining allocation can be distributed towards other categories.

- if the applicants exceed the allocation for a category, the notice refers to a lottery or other process to allocate the capacity.

Advanced energy projects

- Allocates $10 billion credits for qualifying projects.

- At least $4 billion credits tied to energy communities.

- Qualifying projects must re-equip, expand or establish a production or recycling facility for certain energy technologies, including fuel cells, grid modernization equipment and carbon capture.

- A full list of qualifying projects is available in appendix A of the notice.

- The tax credit is not considered a “stackable” bonus credit

- Facilities receiving the advanced manufacturing credit (45X), ITC (48 & 48E), advanced coal credit (48A), gasification credit (48B), carbon capture (45Q) or hydrogen PTC (45V) for the same investment are not eligible.

A path towards the selection process

There are certain limitations that apply to the low-income environmental justice credits – first, the net output must be less than 5 MW AC, and facilities placed-in-service prior to receiving the allocation are not eligible.

The selection process will take a phased approach, with applications for qualified low-income residential buildings and economic benefit projects prioritized starting in the third quarter of 2023.

The notice mentions criteria that could be emphasized in the process, such as

-

- community-based ownership,

- impact on encouraging new market participants,

- commercial readiness and

- benefits to marginalized and low-income communities.

Stay up to date about Pivotal180 and the Inflation Reduction Act.by signing up to our newsletter, see form on this page. In the coming weeks, we will be publishing further analysis about market expectations and tradeoffs between the different tax credit structures.

Please use the links below to find out about Pivotal180 and our financial modelling courses and experience the Pivotal180 difference.

Share This Resource