By Bastian Stroemsheim | March 2, 2024

Corporate PPAs and evolving credit transfer structures

In recent weeks, news around corporate PPAs and the Schneider-Engie tax credit transfer made headlines. Given it’s leap year, don’t forget the impact it could have on financial models! It could save the Australian economy from entering recession territory.

Corporate PPAs

According to Bloomberg NEF, corporate PPA announcements for solar and wind amounted to 46 GW (DC) of capacity in 2023. On the top 10 list, Amazon remains first with close to 8.8 GW (~20% share). As noted by the researchers, Amazon’s total portfolio (33.6GW) is greater than the power generation fleet of countries such as Belgium and Chile. The tech companies Meta, Google and Microsoft continued their presence in the top 10 list, while newcomers included chemical company LyondellBasell and supermarket chain Albert Heijn.

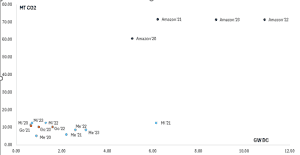

Tracking the annual PPA capacity against the corporate emissions (Scope 1-3) for the tech companies shows a couple of interesting results. First, with Amazon’s noticeable increase in corporate emissions between 2020 and 2021 (~10 MT), a corresponding shift is seen in PPA capacity, particularly for 2022 and 2023. Second, Microsoft’s 2021 PPA capacity is a clear outlier compared to other years and the relative similarity of its emissions profile to Google and Meta. Clearly, 2021 was a big year for PPA procurement for the company.

A couple of quick caveats to mention with this chart – with 2023 GHG metrics currently not available, 2022 GHG metrics have been applied. Second, recognize the lead/lag time between announcing the contracted PPA capacity, when the project becomes operational, and the corporate emissions profile.

A new standard for tax credit transfer?

Latitude Media reported on the $80 million Schneider-Engie tax credit transfer deal. Schneider will purchase the credits to offset against its taxes, but the gain made from the tax savings will be earmarked towards purchasing 110,000 MWh of renewable energy credits (RECs) from Engie projects. The RECs will be used to reduce Schneider’s scope 2 emissions.

Schneider is purchasing the 45X credits (Advanced Manufacturing PTC), which in Crux’s data for 2023 averaged 89 cents/dollar of tax credits and was the second-most considered credit for transactions.

With large price differences between RECs depending on the region and type of market, the underlying transaction also relies on securing a relatively high discount for the tax credits. It remains to be seen if this can be replicated with other credits, but the introduction of the tax credit purchaser reinvesting some of the proceeds towards the offtake revenue is an exciting development.

Please use the links below to find out about Pivotal180 and our financial modelling courses and services. Experience the Pivotal180 difference.

Share This Resource