By Bastian Stroemsheim | June 30, 2024

The final wage and apprenticeship requirements

After the Inflation Reduction Act (IRA) was passed in August 2022, the IRS continues to publish guidance and final regulations to effectively define the fine print of what was set forth in the IRA. This past week, the final regulations for the prevailing wage and apprenticeship requirements were published. These requirements are crucial for projects to comply with, as it results in a 5x multiplier for the ITC and PTC. The ITC moves from a base of 6% of eligible capex or fair market value to 30%.

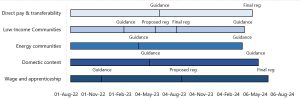

Lost in the flood of IRS updates

Given the volume of updates and range to cover, it has been hard at times to keep track of the latest clarifications from the IRS. See below for some of the key dates for when guidance, proposed regulations and final regulations were published for the different adders. It is clear the IRS picked up the pace for Q1-Q2 2024, yet more updates are expected in the future.

Proposed structure carried into the final regulations

Key elements of the proposed regulations remained intact. The cure payments for prevailing wage and apprenticeship requirements remained the same:

- Prevailing wage: Shortfall x (federal short-term rate + 6%) will be paid to the affected worker, and a $5,000 per worker payment to the IRS. Intentional disregard applies a 3x multiplier to the shortfall calculation and increases the IRS payment to $10,000 per worker.

- Apprenticeship: $50 per missed apprentice hour. Intentional disregard steps up the value from $50 to $500 per missed hour.

Projects with start of construction before January 28, 2023 or a nameplate capacity of <1 MW AC are exempted from the requirements.

Apprentice requirements are divided into meeting separate requirements for total number of hours (12.5% for start of construction <2024, 15% starting 2024 and afterwards), ratios (adequate supervision) and participation (at least 1 apprentice when ≥4 workers).

Changes under the final regulations

The IRS received 342 comments based on the proposed regulations. In a couple of instances, the IRS changed course on some of the requirements. For example, the proposed regulations put a limit on the “Good Faith Effort” exception at 120 days. This meant the taxpayer had to re-submit a request every 120 days to still be excused. Under the final regulations, the threshold is increased from 120 days to 365 days (366 in leap years).

The initial regulations used start of construction to determine the applicable prevailing wage rates. This was changed to when the contracts are signed in the final rulings to allow to reduce cost uncertainty since contractors need to incorporate prevailing wages when bidding for projects.

Frequently, the IRS sought to expand and clarify the current definitions used in the proposed regulations. Repair work, which falls under the prevailing wage requirement during the tax credit tenor, covers activities that 1) improves the facility, 2) involves correction of individual defects that are not recurring or 3) improves the facility’s structural strength, stability, safety, capacity, efficiency or usefulness.

The final regulations only reinforce the need to seek good tax advice and strong protection to remain compliant. Missing out on the ‘full rate’ applied to tax credits can be devastating for the project economics.

Want to learn more about project finance, including new developments post-IRA? Check out the links below to learn more about Pivotal180 including all of our financial modeling courses and services. Come model with us!

- Short Courses – including our new program on post-IRA tax equity!

- Tax Equity Modeling

- Renewable Energy Project Finance Modeling

- Intro to Battery Storage & Financial Modeling

- Infrastructure Project Finance Modeling

- Financial Modeling Advisory & Consulting Services

Share This Resource