By Haydn Palliser | May 6, 2024

Green hydrogen is one of the ‘hottest’ topics around energy town. If you work in energy or the energy transition, you’ve likely looked at hydrogen, and maybe even read a little on the topic.

The thing is, we are a long way off producing green hydrogen to scale to meet future demand. And I often wonder if we are approaching green hydrogen with too narrow a focus, primarily on electrolysis. Let me explain by getting into the use cases, supply and demand, and challenges with getting low-emission hydrogen to scale. I will even show you a technology that could well play a major part in low-emission hydrogen.

What is Hydrogen used for today?

What is hydrogen and what is it used for? Maybe you think you have an idea if you recently watched Oppenheimer… Or perhaps you are aware of Hydrogen’s use in Zeppelins in the past. But times have changed somewhat. Common uses of Hydrogen today include:

- Ammonia production. Ammonia is one of the main ingredients in fertilizer

- Methanol production. Methanol is a common chemical precursor used in countless everyday materials, from paints to plastics

- Petroleum refining. Hydrogen helps convert heavy oils into lighter, more valuable products

Hydrogen is colorless, except on paper (some quick definitions)

Just to get some definitions out the way. You’ll hear about different ‘colors’ of hydrogen. Hydrogen gas is colorless, but the many (creative and kind of non-sensical) colors of hydrogen refer to how it is produced.

Current hydrogen production is almost entirely ‘gray’, ‘brown’, or ‘blue’. Gray hydrogen is produced from methane reforming. Gray hydrogen production produces ~11 tons of C02 per ton of hydrogen produced. Brown hydrogen is created through coal gasification and is more common in emerging markets. Blue hydrogen is produced in the same way as gray, but with additional equipment to capture the C02 emitted through the process. Sidenote: The captured C02 is then piped and trapped underground, adding another layer of complexity…perhaps my next blog).

Current hydrogen production: 90 million Mt per annum = 3% of the world’s total C02 emissions

Almost all ~90 million metric tons (Mt) per year of hydrogen consumed today is produced through the gasification of natural gas or coal. To quote Nick Albanese’s blog (Westly Group) when referring to current Hydrogen emissions– ‘it’s like adding the emissions of the UK and Indonesia together’. A World bank article quoted current emissions from hydrogen production are equal to 3% of the world’s total C02 emissions, or equal to Japan’s total emissions.

However, new hydrogen production methods of ‘green hydrogen’ could be poised to change the emissions profile of the sector.

Green hydrogen: the low-emission hydrogen

Green is used in finance just to make things sound sexy and ‘ESG-like’. But green hydrogen is actually low-emission. Green hydrogen most commonly refers to creating hydrogen by splitting water (H2O) into hydrogen and oxygen using renewable electricity. Renewable electricity and water are passed through a piece of equipment called an electrolyser. You may think green hydrogen is a big thing right now. Except it only accounted for 0.1% of hydrogen production in 2023!

If you like images to explain things, check out the image below from Lazard.

What are the most likely new use cases for green Hydrogen?

The business case for green hydrogen largely focuses on reducing CO2 emissions in typically “hard-to-abate” sectors. Some of the most talked about new use cases for green hydrogen are:

- Fuel cells. Hydrogen can be used in Fuel cells to produce green electricity efficiently (and for long durations) for a variety of end uses

- Low emission transport (fuel for ships, rail, vehicles, and airplanes)

- Energy production

- Industrial processes such as low-carbon steel, food processing, and manufacturing

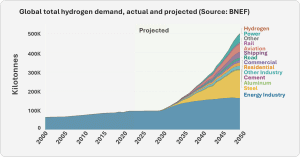

Green hydrogen demand is expected to grow

Most industry experts see low-emission hydrogen demand increasing in the coming years. The International Energy Agency sees between 7Mt and 69Mt of annual low-emission hydrogen demand by 2030; up from almost zero production today. Most of the demand is expected in the newer industries, such as in fuel cells or producing green steel. (Side note: there are some cool businesses seeking to produce green steel without hydrogen, such as Electra, so demand for hydrogen in the steel industry could be lower than expected.

We could argue about this forecast all day long. But one of my favorite sayings is that the only thing we know about a forecast is that it is wrong. Still, we need some basis for decision-making and I can get behind the view that we expect low-emission hydrogen demand to increase.

Supply of green hydrogen is not forecast to meet future demand

The graph below is from the IEA It shows that we are a long way from meeting the 2030 targets. 2030 is only 6 years away. And we all know that it takes a long time to develop, permit, and produce new projects. If the demand projections are even close to accurate, we need significant low-emission hydrogen development, and soon.

If you want to read more about Green Hydrogen markets and supply/demand, I encourage you to read the International Energy Agency (IEA) Global Hydrogen Review 2023.

We need green hydrogen: but it’s just not that easy to scale to meet demand.

What often isn’t communicated when you read about green hydrogen is the length of the broader supply chain that starts with production of hydrogen and ends with delivery to the end user (as shown below).

So, what are the issues:

- New renewable projects can’t keep up: We need many new renewable electricity projects to produce green hydrogen with electrolyzers. These take years to develop and don’t make economic sense in some areas with little wind, sun, or rain.

- Electrolysis is inefficient: About 30-40% of the energy input into the electrolysers is stored. The remaining 60-70% is wasted. We also need water (~9-18 tons of purified water per ton of hydrogen), which isn’t always available at the location where hydrogen could be produced.

- Production costs are high: Green hydrogen start-ups often forecast hydrogen production costs to be as low as $2-$3/kg of Hydrogen. The main operating cost in electrolysis is electricity. One issue is that the $2-$3/kg prices assume energy prices at roughly half the actual cost of energy from new renewable energy projects today. Recent green hydrogen bid prices in Europe have been closer to $8/kg. Electrolysers themselves have also been increasing in cost.

- Distribution networks don’t exist: Sure, we have gas pipelines. But those pipelines aren’t naturally flowing from where power plants and hydrogen projects are (or will be) to where the end users (or ports) are. Existing natural gas pipelines only have limited use for hydrogen transport such as blending hydrogen with natural gas. The coordination and development of these hydrogen pipelines will take a VERY long time (possibly 10+ years). That’s if they ever even get built. The IEA estimates we need to spend ~$35 billion per year (40% of the total annual spending on existing pipelines and shipping) to develop these pipelines.

- Transport and storage costs add up: Not to mention that the transport itself may not be particularly green if we look at the full supply chain. But who am I to get in the way of a good story…..

- Economically reliant on fickle government policies: To keep prices down, governments around the world provide tax and price support incentives for hydrogen. These subsidies could disappear with a change in government. To put this in perspective, blue hydrogen (with C02 capture) is half the cost (or less) of green hydrogen, and grey hydrogen is around half the cost of blue Hydrogen (with some recent bids in Europe being ~$1/kg). The policies need to be high enough to make green hydrogen projects stack up and compete on price. I am not saying these are necessarily bad. Solar energy is largely successful due to Government incentives. But the point is that without generous incentives, green hydrogen could fall flat on its back.

- Funding is hard to come by: This shouldn’t be a surprise. All new technologies and markets have difficulty raising funding. It’s particularly challenging today to obtain long-term offtake contracts to enable project financing.

- Is green hydrogen really ‘green’? No, it’s colorless. Think about all the steps: producing hydrogen, transporting it to a port, storing it at the port, compressing it on the ship, traveling across the world, and reversing that process on arrival…the emissions add up!

Green hydrogen by electrolysis is expensive, inefficient, and has major locational challenges. Look, there will be some projects that can produce cost-competitive green hydrogen at the location required. FYI the US Clean Hydrogen Hubs being developed are focused on building infrastructure at scale in regions where the hydrogen can be used. That helps reduce hydrogen transport costs, but hydrogen is required in very diverse geographic regions.

Bottom line: I don’t believe that electrolysis alone can fully power the planned expansion of hydrogen’s use in the economy. I am not saying that electrolysis won’t be feasible in certain situations. Just that maybe there are some other low-emissions options that could be considered.

What if we could produce cheap, clean hydrogen where hydrogen is used (distributed hydrogen)?

What if we could produce hydrogen directly where it is needed? And what if we could do this without the need for lots of new renewable electric facilities and pipelines that we don’t yet have? What if hydrogen can be produced from cheap and readily available feedstocks? Well, Grimes Carbon Tech is one such company aiming to do just that.

For the avoidance of doubt, I am on the Advisory Board of Grimes Carbon Tech. But this isn’t a shameless plug. I joined the board because I see potential. So, what exactly are they intending to do?

Grimes Carbon Tech: An opportunity

Grimes Carbon tech purportedly has:

- Technology that is 30x as energy efficient as electrolysis: The plant can be run on waste heat alone (something almost all hydrogen users have in abundance and pay to get rid of), or very low amounts of electrical energy (2-3 MWh/t of H2).

- Produces clean hydrogen from a wide array of easily available feedstocks: From ethanol, agave syrup, methanol, and a wide other range of feedstocks using a low-temperature, liquid phase natural process. The variable feedstocks provide options for where the plant can be located.

- Distributed plants: Think of shipping containers located at the site where hydrogen is required. There isn’t a need to pipe, compress, or store hydrogen meaning that delivery costs are effectively zero.

- Modular and scalable: The technology can be scaled up or down by stacking production units on top of each other. Small and large projects are possible.

- Financially sustainable: Levelized costs are low, meaning clean hydrogen could compete with grey hydrogen. Levelized costs using some feedstocks are even lower than shown above (the above is for agave syrup). Note also that the levelized costs don’t even account for the $0.6-$3/kg production tax credit for clean hydrogen, which will lower the cost if considered.

Even if you don’t care about the green part, the economics appear compelling. The opportunities in developing markets are also meaningful as you can produce hydrogen locally. Grimes Carbon Tech also has plans to develop Sustainable Aviation Fuel from recycled carbon for ~$100/bbl – but perhaps this is for another blog.

If you are interested in hearing more about Grimes Carbon Tech – please reach out to Joseph Maceda, (info@grimescarbontech.com) to learn more.

Times have changed. It’s been 20 years since my early days in wind and solar. Perhaps we will spend more time on some of these new technologies in the future. It’s going to be an interesting industry to watch.

For more Pivotal180 content on green hydrogen, check out our previous blog posts:

- ICYMI: US Department of Energy Announces 7 Clean Hydrogen Hubs

- Hydrogen: A Key Player in the Net-Zero Race

- Hydrogenating Storage

- A Hydrogen Economy with the Inflation Reduction Act

- US hydrogen sector updates: new proposed rules for 45V eligibility

Please use the links below to find out about Pivotal180 and our financial modelling courses and services. Experience the Pivotal180 difference.

Share This Resource